Dividend Policy

The Steadfast Board targets a dividend payout ratio in the range of 65% to 85% of net profit after tax attributable to Steadfast shareholders, with a minimum dividend payout ratio of 50% of net profit after tax and before amortisation expense.

The Steadfast Board expects that dividends will be fully franked and paid in March and September each year.

The Steadfast Board does not provide any assurance of the future level of dividends or to the extent to which they are fully franked, and there may be periods in respect of which dividends are not paid. However, as a majority of Steadfast’s profits are derived in Australia, significant franking credits are expected to be generated.

Dividend Reinvestment Plan (DRP)

The Directors have established a dividend reinvestment plan (DRP) which is applicable for the current dividend. For a copy of the DRP please click

hereOpens in new window.

You can register for the DRP online (if the market value of your shares is less than $50,000) or fill out the

DRP formOpens in new window

and mail it to our Share Registrar, MUFG Corporate Markets (AU) Limited.

To register online,

click hereOpens in new window

and type in your holder number and postcode.

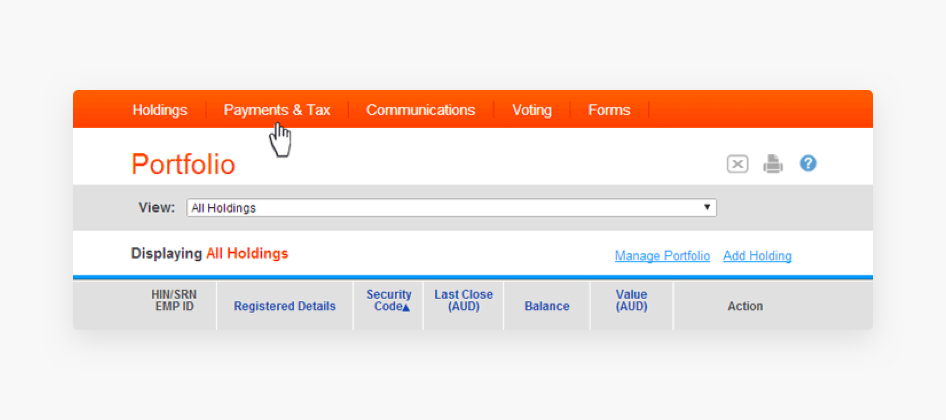

Once logged in, select Payments & Tax from the headings.

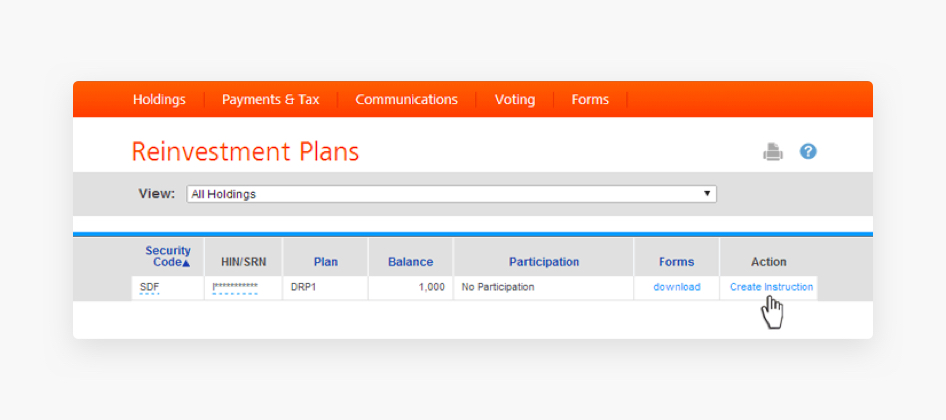

Then select Reinvestment Plans from the drop down menu and the page below will appear.

Select Create instruction and follow the prompts.